Stakeholder Mapping: How to Identify the Real Influencers in Your Organization

December 3, 2025Stakeholder mapping identifies who truly influences your organization. Discover why traditional models fail and how ONA data shows actual collaboration patterns.

I've seen too many change initiatives fail because companies focused on the wrong people. The org chart says one thing. Reality says another.

Real stakeholder mapping goes beyond hierarchies. It shows you who people actually listen to, who spreads information, and who can make or break your initiative.

In this article, I'll walk you through what stakeholder mapping really means, common models for identifying stakeholders, and how Organizational Network Analysis (ONA) reveals the informal leaders that traditional methods miss.

What Is Stakeholder Mapping

Stakeholder mapping is the process of identifying all individuals who are affected by or have the potential to affect your project or initiative.

Unfortunately, most stakeholder maps stop at identifying names on an org chart.

Real stakeholder mapping means understanding:

- Who has formal authority

- Who has informal influence

- Who controls information flow

- Who people trust for guidance

- Who connects different groups

Let’s say your project needs approval from the VP of Operations. That's formal authority. But if the entire operations team trusts a senior engineer who's been there for ten years, that engineer is your real stakeholder.

Miss that engineer, and you'll struggle to get buy-in from the people who actually do the work.

Learn more about ONA

Learn about the benefits and best practices of Organizational Network Analysis

Learn MoreKey Aspects of Stakeholder Mapping

Effective stakeholder mapping requires you to look at several dimensions:

Power and Influence

- Who can approve decisions?

- Who can block them?

These aren't always the same people. A manager might have approval authority, but a trusted team lead might hold the real influence.

Interest and Impact

You need to identify how much each stakeholder cares about your initiative and how much it will affect their work. High interest doesn't always come from high-level roles.

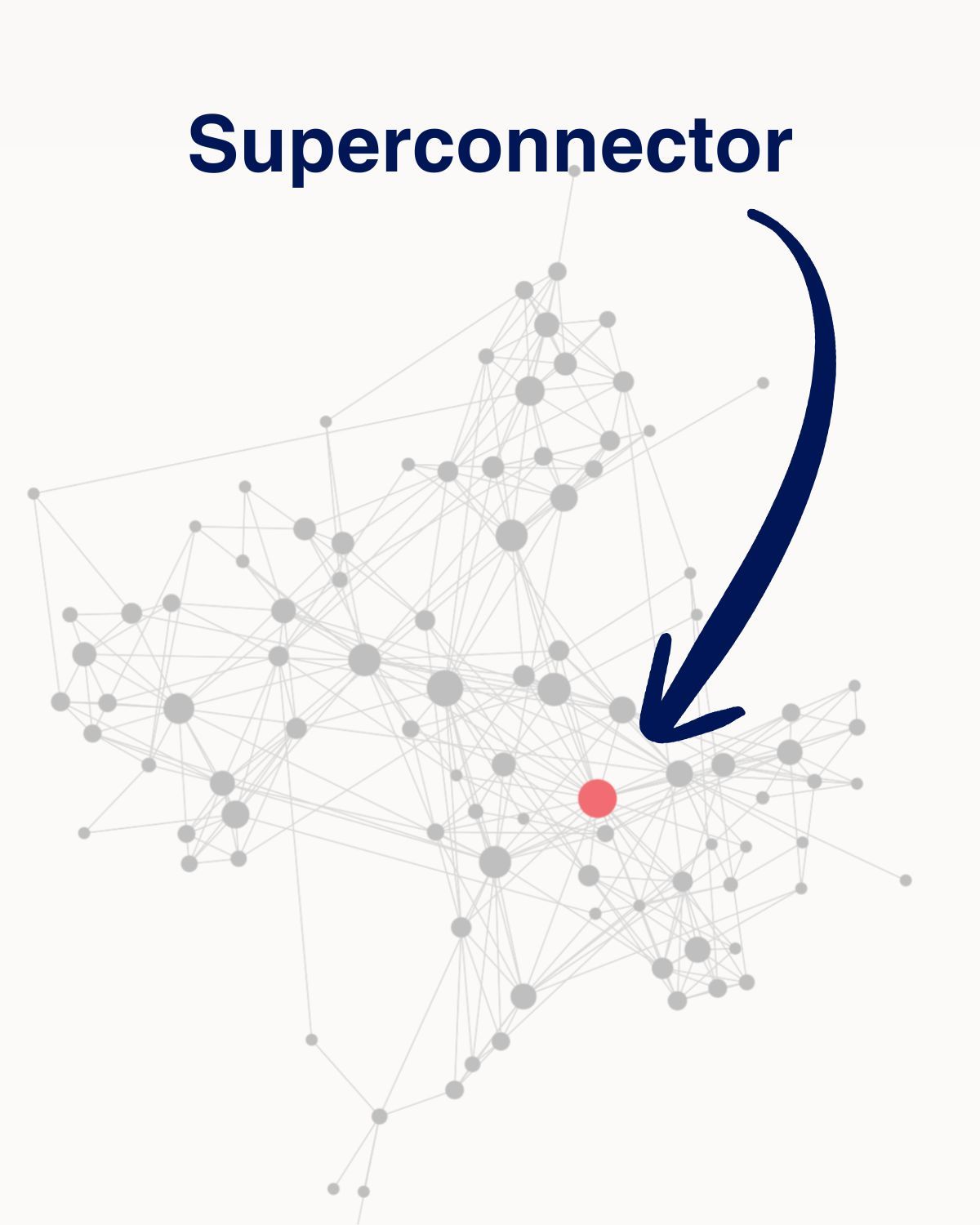

Connections and Networks

- Who talks to whom?

- Who bridges different departments?

These superconnectors often determine whether information spreads or dies in silos.

Trust and Credibility

Who do people believe? A new manager might have the title, but a long-tenured employee often holds the trust.

Communication Preferences

How does each stakeholder like to receive information? Some want detailed reports. Others prefer quick conversations.

Traditional stakeholder mapping tools only capture the first two dimensions well. They miss the networks, trust relationships, and actual communication patterns that make a change management plan work.

When You Need Stakeholder Mapping

Let me be clear: you don't need detailed stakeholder mapping for every small decision. But there are specific situations where it becomes critical.

1. Major Change Initiatives

Rolling out new systems, restructuring departments, or shifting company strategy — these all require stakeholder mapping.

Why? Because change fails when people resist it. And people resist when they don't understand it or when it comes from someone they don't trust.

I've seen companies spend millions on new technology only to have adoption rates below 30%. The problem wasn't the technology. It was that they didn't identify and engage the influencers who could have championed the change.

2. Mergers and Acquisitions

When two companies combine, you're merging two different networks. Different cultures. Different informal hierarchies. Different trust relationships.

You need to map stakeholders on both sides.

- Who holds influence in the acquired company?

- Who are the connectors between old and new teams?

- Who might resist the integration?

Without this mapping, you risk losing key talent and creating deeper silos instead of one unified organization.

3. Cross-Functional Projects

Any project that requires multiple departments to collaborate needs stakeholder mapping.

Marketing needs engineering support. Sales needs product input. Operations needs IT resources. These handoffs are where projects stall.

Stakeholder mapping shows you who connects these departments, who can bridge the gaps, and who needs to be involved to make collaboration happen.

4. Strategic Upskilling or New Capability Rollouts

Right now, many organizations are trying to upskill their workforce on AI. This is a huge change that touches every department.

To run a successful upskilling program, you need to understand the fundamentals:

- Who do people trust for technical guidance?

- Who are the early adopters who can demonstrate value?

- Who are the skeptics who need special attention?

Without mapping these stakeholders, your training program becomes another ignored initiative. People complete the modules but don't change their behavior.

The same applies to any new capability: agile methodologies, design thinking, data literacy. You need to identify who will spread adoption and who might block it.

The Importance of Stakeholder Mapping: Centralized Power or Distributed Authority?

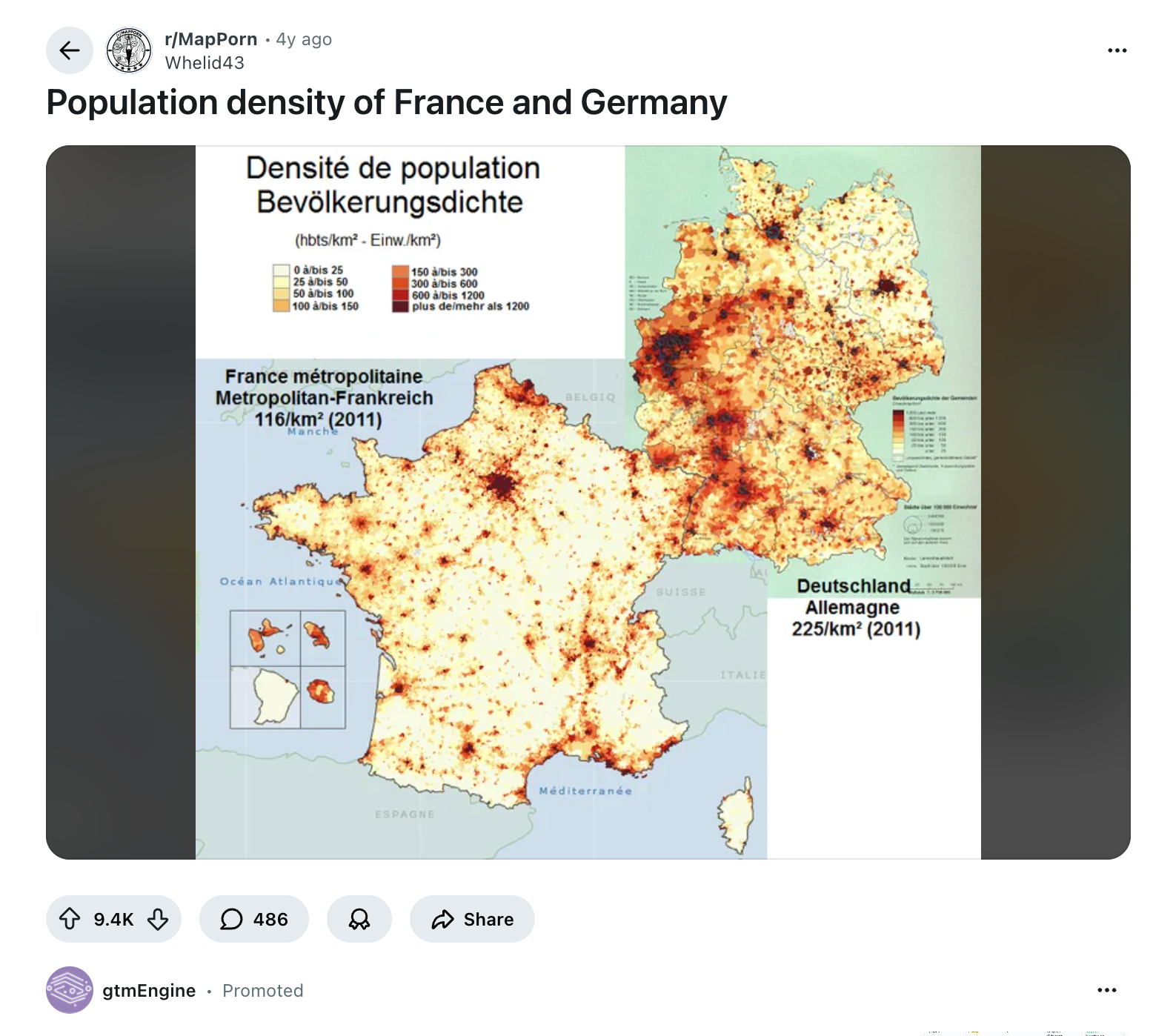

Here's a question I love asking leaders: Is your company more like Germany or France?

Look at these population density maps of both countries. France shows intense centralization around Paris. Germany shows distributed centers across the western regions.

France has Paris. Germany has multiple strong cities: Hamburg, Berlin, Munich, Frankfurt, Cologne.

The difference matters. Germany's GDP per capita is about 20% higher than France's. Paris might be more iconic than any German city, but Germany's distributed model produces better results.

Your organization works the same way.

The France Model: Centralized Power

Some companies operate like France. Everything flows through the CEO or a small executive team. They're highly visible. Everyone knows their names. But this creates bottlenecks.

Information has to travel up, get processed, and flow back down. Decisions move slowly. Local teams can't act without approval from the center.

You might have an iconic leader. But you probably don't have the agility you need.

The Germany Model: Distributed Authority

Other companies operate like Germany. They have strong leaders at multiple levels. Department heads make decisions. Teams have autonomy. Information flows horizontally between groups.

This creates resilience. If one leader leaves, the organization keeps functioning. Teams don't wait for central approval to solve problems.

What This Means for Stakeholder Mapping

If you only map stakeholders at the top of your org chart, you're seeing the France model. One center of power. Clear hierarchy.

But if your organization actually operates like Germany, with distributed influence and informal leaders throughout, your stakeholder map is wrong.

You'll invest time convincing people who don't actually drive behavior. You'll miss the connectors who spread information. You'll ignore the trusted voices that teams follow.

This is why so many change initiatives feel like pushing a boulder uphill. You're trying to run a Germany-style organization with a France-style stakeholder map.

5 Common Stakeholder Mapping Models

To conduct stakeholder mapping correctly, you need to decide which model you’re going to use. In this section, I’ll walk you through the most common models for stakeholder mapping, their strengths and limitations, as well as provide an alternative solution.

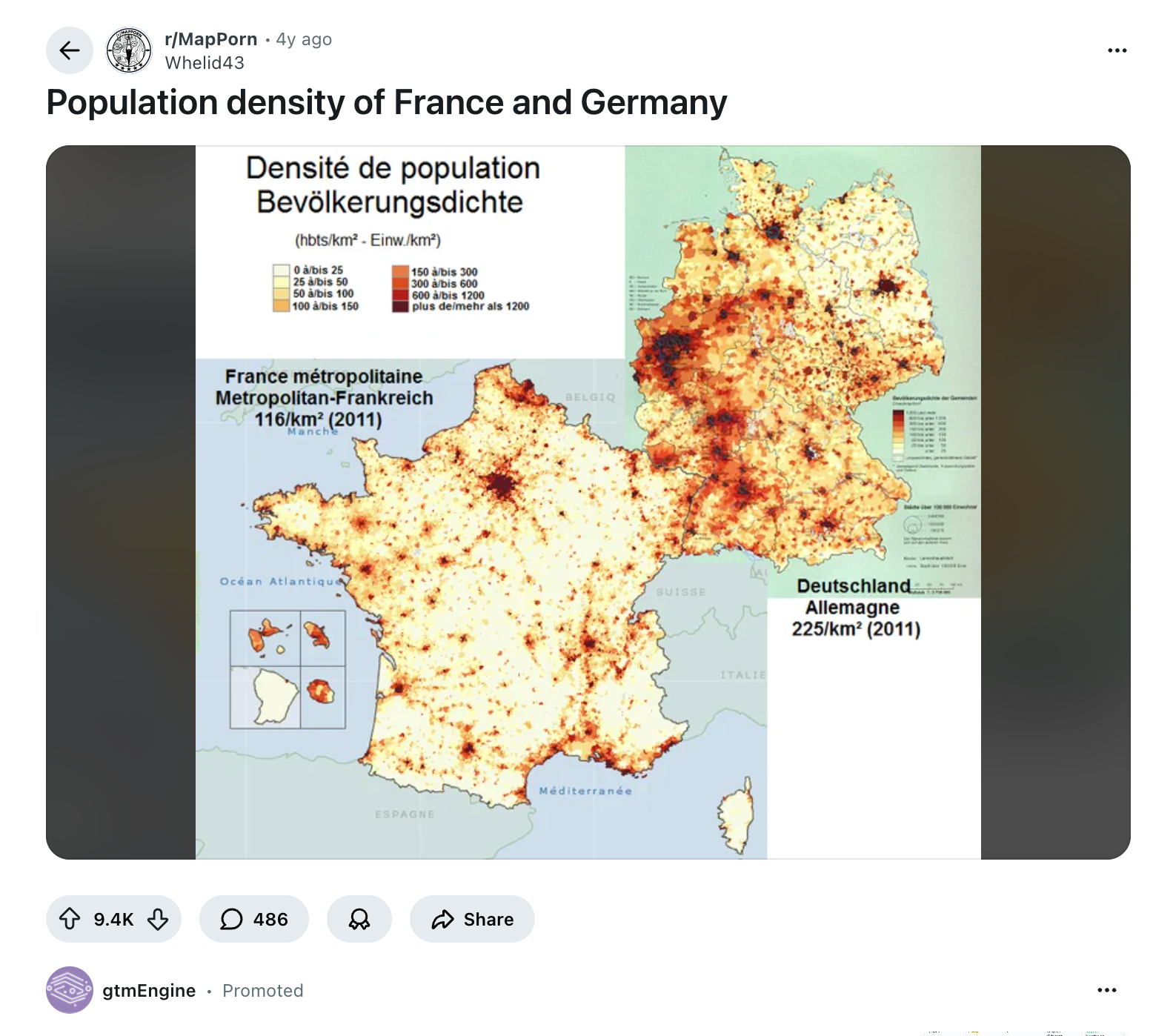

1. Power-Interest Grid

This model plots stakeholders on two axes: power (ability to influence outcomes) and interest (level of concern about the project).

You get four quadrants:

- High power, high interest: Manage closely

- High power, low interest: Keep satisfied

- Low power, high interest: Keep informed

- Low power, low interest: Monitor

It's simple. It's visual. But it's also static. You're guessing at power and interest levels based on titles and meetings.

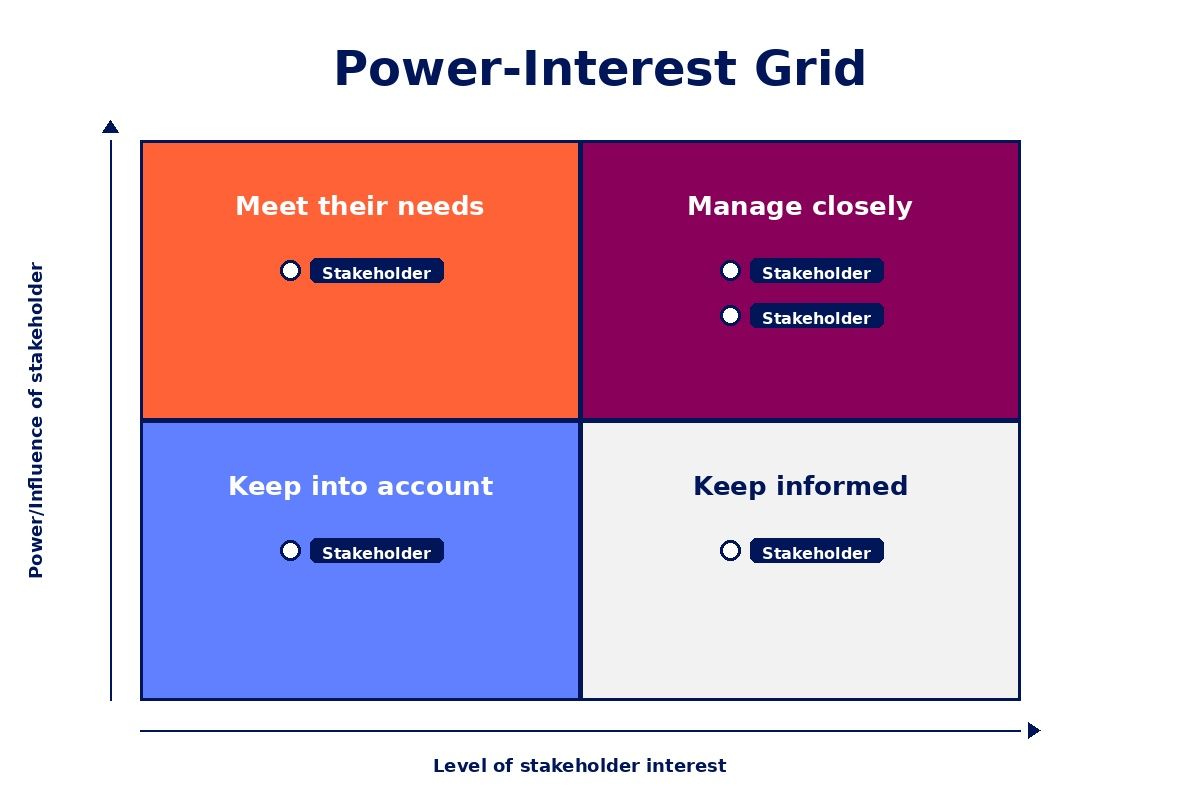

2. Influence-Impact Matrix

Similar to the power-interest grid, but focuses on influence (ability to affect others' opinions) and impact (how much the project affects them).

Again, you categorize stakeholders and create engagement strategies for each group.

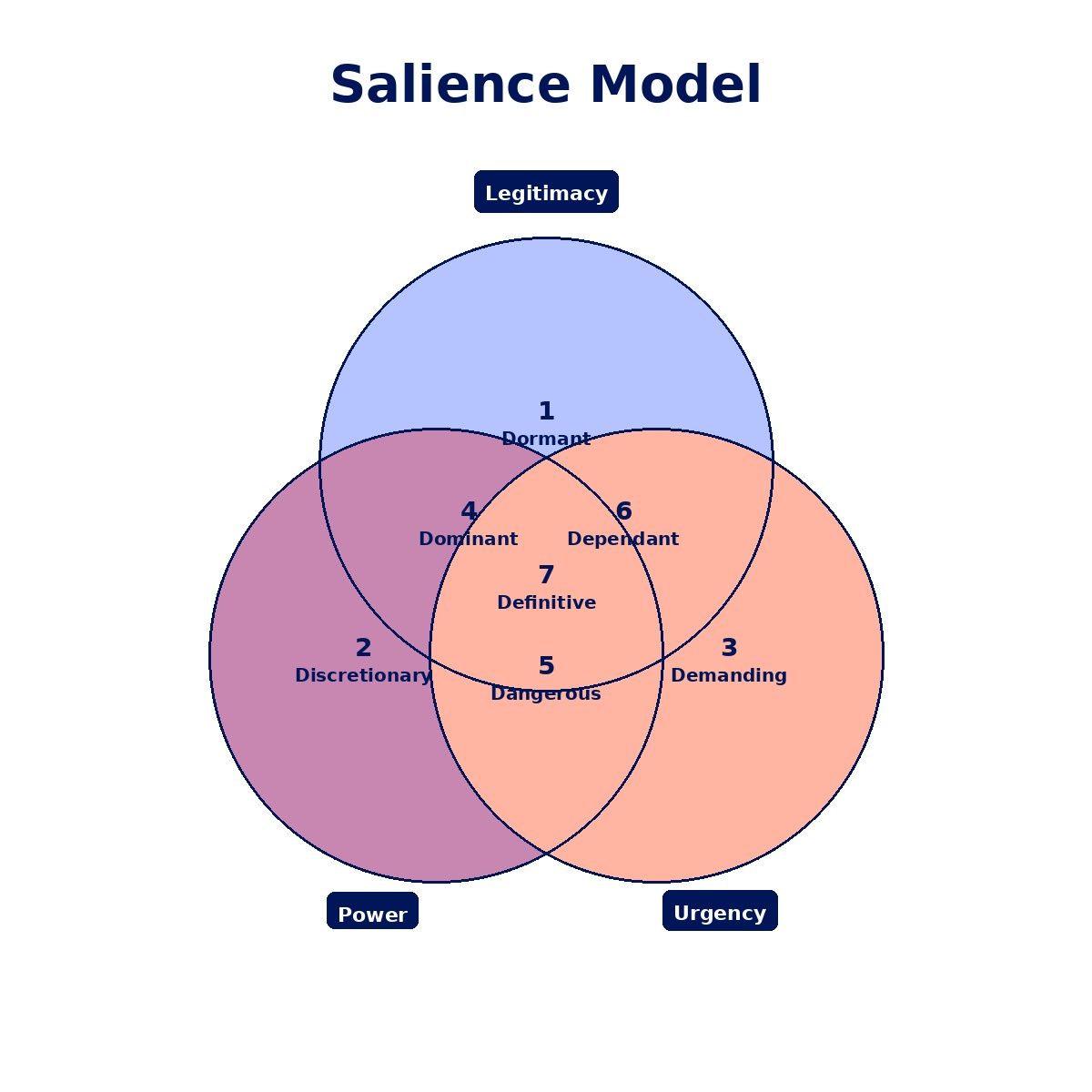

3. Salience Model

This model adds a third dimension: legitimacy. It considers:

- Power: Can they affect your project?

- Legitimacy: Do they have a rightful claim to involvement?

- Urgency: Does their claim require immediate attention?

Stakeholders with all three attributes get priority. It's more sophisticated than the grid models.

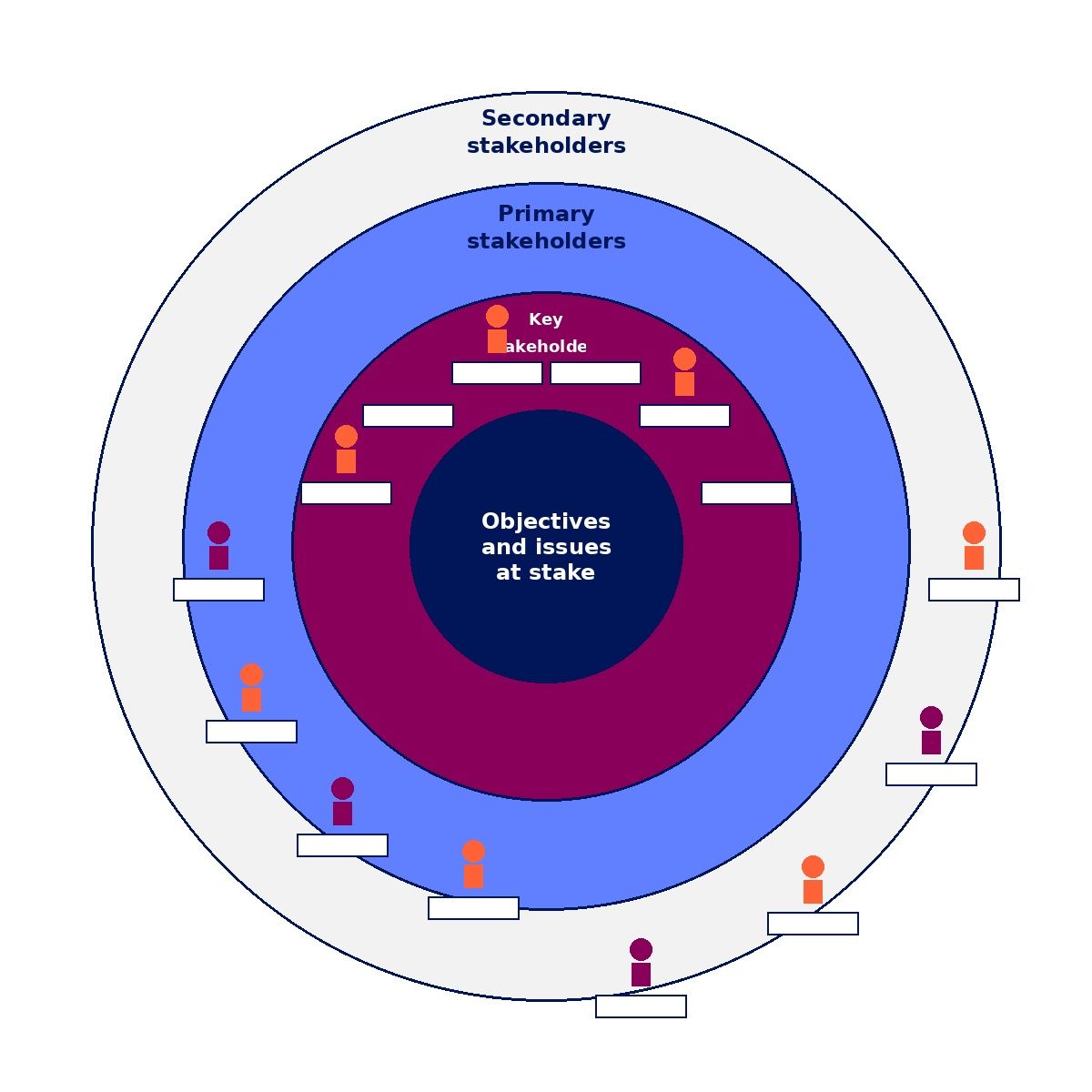

4. Stakeholder Circle

This visual model places stakeholders in concentric circles based on their proximity to the project.

Inner circle: Core team Middle circles: Significant influencers Outer circles: Peripheral stakeholders

You can also add attributes like attitude (supporter, neutral, blocker) and communication preferences.

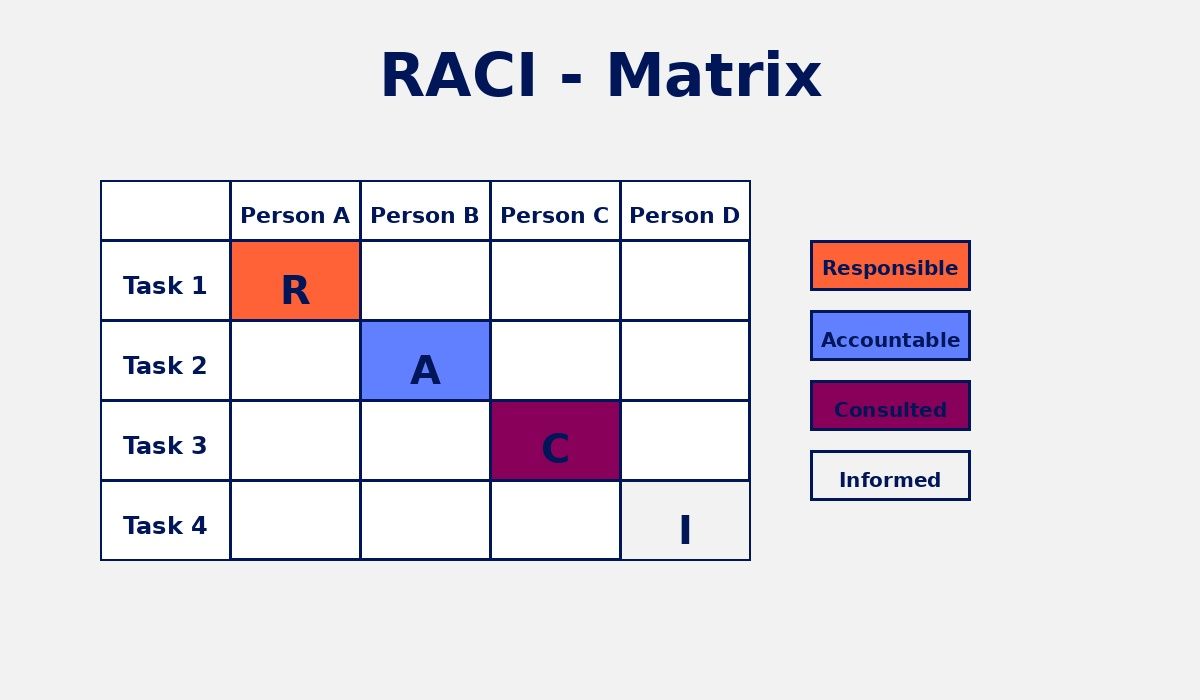

5. RACI Matrix

RACI stands for Responsible, Accountable, Consulted, and Informed. This model maps stakeholders to specific roles in each project task or decision.

It's particularly useful for clarifying decision rights and avoiding confusion about who does what.

The Limitation of Traditional Models

Here's what all these models have in common: they're static and perception-based.

You create them in a workshop. People share their opinions about who has power or influence. You map it out. You move on.

Three months later, someone leaves. Teams reorganize. New people build influence through their work. Your stakeholder map is outdated.

Worse, these models rely on what people think happens. Not what actually happens.

Your VP might believe the engineering team follows formal processes. But maybe they really listen to a senior developer who's been there for years. Your stakeholder map won't show that.

This is where ONA changes everything. It doesn't rely on perceptions. It uses actual collaboration data: who talks to whom, who people turn to for advice, who connects different groups.

It updates continuously. It reveals the informal networks that traditional models miss. It shows you the Germany model when everyone assumed you had the France model.

Stakeholder Mapping Software: From Basics to ONA

When you search for stakeholder mapping tools, you'll find dozens of options. Let me walk you through what's available and why most tools miss the mark.

1. Spreadsheet Templates (Excel, Google Sheets)

The most basic approach. Templates with columns for stakeholder name, role, influence level, interest level, and engagement strategy.

What they do well: Simple to use. Free. Easy to customize. Good for small projects with few stakeholders.

The limitation: Completely manual. You're guessing at influence and interest levels. No data to back up your assessments. Gets unwieldy fast with large stakeholder groups.

2. Project Management Tools (Asana, Monday.com, Smartsheet)

These platforms include stakeholder mapping features as part of project planning.

What they do well: Integrate stakeholder tracking with project tasks. Allow team collaboration. Keep stakeholder information in one place with your project plan.

The limitation: Still based on manual input. They organize your assumptions but don't validate them. They track stakeholders you already identified but don't reveal the ones you missed.

3. Dedicated Stakeholder Mapping Software (Smaply, Miro, Lucidchart)

Purpose-built tools for creating stakeholder maps and matrices. Visual interfaces for plotting stakeholders on power-interest grids or influence-impact matrices.

What they do well: Professional visualizations. Multiple mapping frameworks. Collaboration features. Good for presenting stakeholder analysis to leadership.

The limitation: They make your manual analysis look pretty, but they don't make it accurate. You're still guessing who has influence based on titles and meetings. The map reflects your perceptions, not reality.

4. CRM and Relationship Management Tools (Salesforce, HubSpot)

These track stakeholder relationships, particularly external ones like clients, partners, and vendors.

What they do well: Comprehensive relationship history. Track interactions and communications. Good for managing ongoing stakeholder relationships.

The limitation: Focused on external stakeholders. Limited visibility into internal influence networks. Track formal relationships but miss informal ones.

5. Survey and Feedback Tools (SurveyMonkey, Typeform, Qualtrics)

Some companies use surveys to gather stakeholder input and assess attitudes toward projects or changes.

What they do well: Capture stakeholder opinions directly. Measure sentiment and concerns. Provide quantitative data on stakeholder positions.

The limitation: People tell you how they feel, but not who actually influences them. Response rates can be low. Doesn't reveal the network structure that determines how influence spreads.

Why Traditional Tools Aren't Enough

Notice the pattern? All these tools do the same thing: they organize and visualize information you manually input.

They don't tell you:

- Who actually has influence (not who should have it based on their title)

- How information really flows through your organization

- Which stakeholders are connected to which others

- Who the super-connectors are that reach most of the organization

- Where bottlenecks and silos exist that will block your initiative

Traditional tools assume you already know who matters. They help you track those people. But they can't reveal the informal influencers you're missing.

This is where Organizational Network Analysis changes everything.

Why ONA-Based Stakeholder Mapping Works Better

ONA doesn't rely on your assumptions. It uses actual data about how people connect and collaborate.

Let me show you what ONA reveals that traditional tools can't.

Organizational Network Analysis gives you what traditional stakeholder mapping can't: data on how people actually connect. Let me show you what ONA reveals.

Finding the Real Influencers

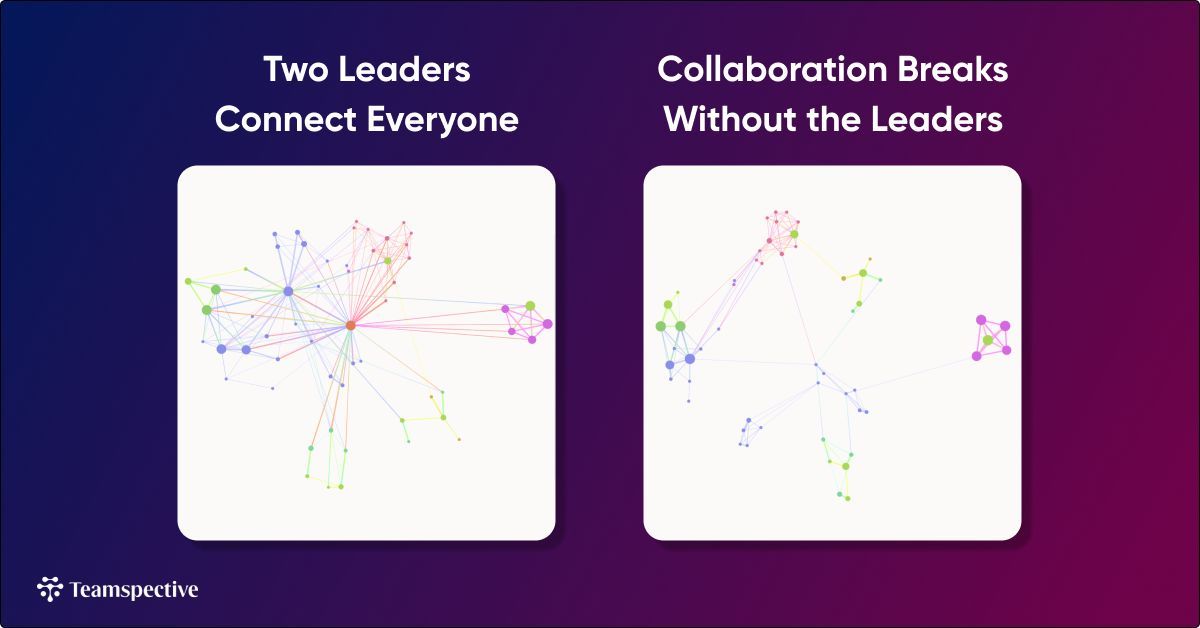

ONA identifies people with the most connections. In any group, about 3% of people hold the most influence. If you engage this 3%, you can reach 75-85% of the organization through their networks.

Here's why that matters. When you're leading change, you need early adopters to spread the message. The 3% rule tells you exactly who those people should be.

A manager might not be the best person to reach a certain group. Instead, teams often rely on a senior employee who's been there from day one. That senior employee might have more connections and more trust than someone with a fancier title.

ONA shows you who that person is.

Revealing Hidden Collaboration Patterns

ONA maps how different departments work together. You might discover that sales and product rarely connect, even though they should. Or that engineering depends entirely on one person to communicate with marketing.

I've seen this firsthand. One company found that information between sales and product only flowed through a single product manager. When that person went on vacation, communication stopped. That's a massive risk.

ONA also shows you where silos exist. If teams are detached from the rest of the organization, you need to create new connections before launching any change initiative.

Identifying Succession Risks

Who holds critical knowledge? Who connects groups that otherwise wouldn't talk?

ONA reveals your single points of failure. These are people who, if they left tomorrow, would break critical workflows. You need these people in your stakeholder map because they're essential to your operations.

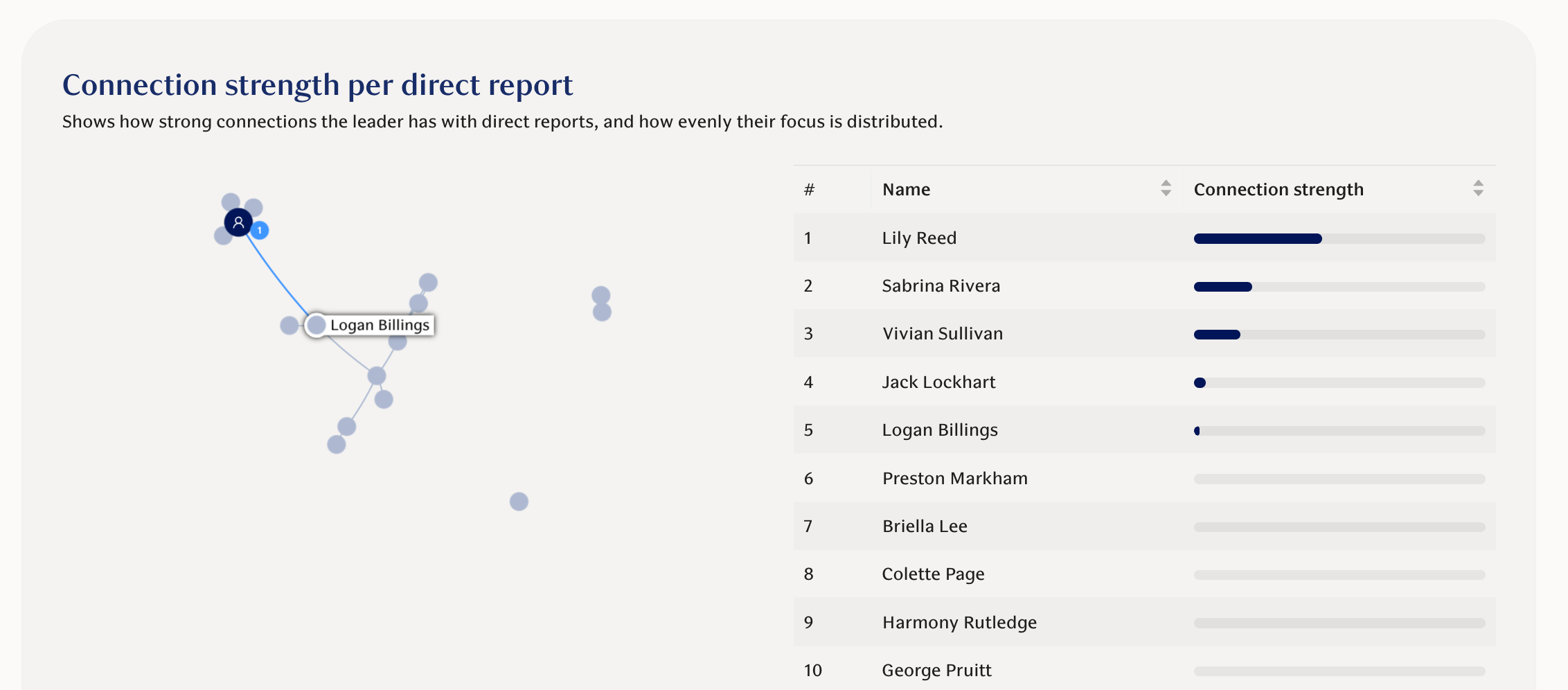

Understanding Leadership Styles

Not all leaders operate the same way. Some are manager-driven. They control information and decision-making flows through them. Others empower distributed teamwork where the team connects directly with other groups.

ONA shows you which model each leader follows. This matters because different change approaches work for different leadership styles.

How to Do Stakeholder Mapping with ONA Tools

Let me walk you through how ONA actually works for stakeholder mapping.

Step 1: Collect Network Data

ONA tools gather data about connections and collaboration in two ways:

Active surveys ask employees specific questions about their networks:

- Who do you turn to for expertise?

- Who do you collaborate with most often?

- Who do you trust for leadership guidance?

These surveys take about 8 minutes. They give you deep insights into expertise networks, leadership connections, and cultural ties.

Passive data comes from your existing systems. Calendar integrations show meeting patterns. Communication tools reveal who talks to whom. Project management systems show collaboration on deliverables.

The beauty of passive data? You get continuous updates without jeopardizing employees’ privacy or asking employees to fill out surveys every month.

Step 2: Identify the Critical 3%

Remember the 3% rule I mentioned earlier? ONA tools automatically identify the people with the most connections.

These are your super-connectors. In any change initiative, engaging them first means you can reach 75-85% of the organization through their networks.

You don't have to guess who these people are based on job titles. The data shows you exactly who holds influence.

Step 3: Map Collaboration Patterns

ONA creates visual maps showing how different teams and departments connect.

You'll see:

- Which teams collaborate frequently

- Which teams are isolated (silos)

- Who bridges different groups (connectors)

- Who's overburdened with too many connections (burnout risks)

For stakeholder mapping, this reveals the informal structure of your organization. You can identify which departments need stronger connections before launching a cross-functional project.

Step 4: Analyze Leadership Styles

ONA shows whether each leader operates in a manager-driven style (all information flows through them) or an empowered style (the team connects directly with others).

This matters for stakeholder engagement. Manager-driven leaders need different approaches than those who've already distributed decision-making.

Step 5: Combine with Engagement and Performance Data

Here's where tools like Teamspective add value. ONA alone shows you the network. But you need context.

- Are disconnected teams performing poorly? That's a problem to fix.

- Are highly connected teams burning out? You need to redistribute work.

- Is a change initiative causing engagement to drop in specific groups? You can identify resistance early and address it.

By combining network data with engagement surveys and performance metrics, you get a complete picture of what’s working and what’s not.

Step 6: Run Continuous Analysis

Unlike traditional stakeholder maps that you create once and file away, ONA provides ongoing insights.

Passive data updates automatically. You can run pulse surveys to track how networks evolve. You see when new influencers emerge or when critical connectors leave.

This means your stakeholder map stays current. You're not making decisions based on three-month-old assumptions.

Step 7: Take Targeted Action

Once you've mapped stakeholders through ONA, you can design precise interventions:

- For change management, engage the influential 3% first. Give them early access. Address their concerns. Let them become your champions.

- For cross-functional projects, identify the connectors between departments and ensure they're involved from day one.

- For succession planning, find alternatives for single points of failure. Create redundant connections before someone critical leaves.

- For onboarding, connect new hires with people who understand how work actually gets done, not just what the org chart says.

The Benefits of Stakeholder Mapping

When you map stakeholders correctly (including the informal influencers that ONA reveals) you get several benefits.

Faster Change Adoption

You reach the right people first. They spread your message through their networks. This cuts the time needed for organization-wide adoption.

Better Resource Allocation

You stop wasting time on people who won't move the needle. You focus energy on influencers who actually drive behavior.

Reduced Risk

You identify single points of failure before they become problems. You spot disconnected teams that might resist change. You find overburdened employees before they burn out.

Improved Communication

You understand how information flows. You can design communication plans that follow natural pathways rather than fighting against them.

Higher Success Rates

Projects that include proper stakeholder mapping have better outcomes. You've aligned the people who matter. You've addressed concerns from trusted voices. You've built support through existing networks.

Organizational Resilience

When you distribute influence (the Germany model), your organization becomes more resilient. You're not dependent on a few central figures. You have strong leaders and connectors throughout.

Conclusion

Stakeholder mapping is all about understanding who really holds influence in your organization. Who people trust. Who spreads information. Who connects different groups.

Traditional methods give you the org chart. ONA gives you the real network.

I've seen the difference this makes. Companies that map stakeholders based on actual connections, not just job titles, have change initiatives that move faster and face less resistance. They operate like Germany: distributed power, multiple centers of influence, resilient networks.

If you're planning a change initiative, implementing new technology, or trying to improve collaboration, start with proper stakeholder mapping. Use ONA to reveal the informal networks that actually drive behavior.

Ready to see the power of ONA for stakeholder mapping? Book a demo today, and let our team of experts guide you.

Look at these population density maps of both countries. France shows intense centralization around Paris. Germany shows distributed centers across the western regions.

France has Paris. Germany has multiple strong cities: Hamburg, Berlin, Munich, Frankfurt, Cologne.

The difference matters. Germany's GDP per capita is about 20% higher than France's. Paris might be more iconic than any German city, but Germany's distributed model produces better results.

Your organization works the same way.

The France Model: Centralized Power

Some companies operate like France. Everything flows through the CEO or a small executive team. They're highly visible. Everyone knows their names. But this creates bottlenecks.

Information has to travel up, get processed, and flow back down. Decisions move slowly. Local teams can't act without approval from the center.

You might have an iconic leader. But you probably don't have the agility you need.

The Germany Model: Distributed Authority

Other companies operate like Germany. They have strong leaders at multiple levels. Department heads make decisions. Teams have autonomy. Information flows horizontally between groups.

This creates resilience. If one leader leaves, the organization keeps functioning. Teams don't wait for central approval to solve problems.

What This Means for Stakeholder Mapping

If you only map stakeholders at the top of your org chart, you're seeing the France model. One center of power. Clear hierarchy.

But if your organization actually operates like Germany, with distributed influence and informal leaders throughout, your stakeholder map is wrong.

You'll invest time convincing people who don't actually drive behavior. You'll miss the connectors who spread information. You'll ignore the trusted voices that teams follow.

This is why so many change initiatives feel like pushing a boulder uphill. You're trying to run a Germany-style organization with a France-style stakeholder map.

5 Common Stakeholder Mapping Models

To conduct stakeholder mapping correctly, you need to decide which model you’re going to use. In this section, I’ll walk you through the most common models for stakeholder mapping, their strengths and limitations, as well as provide an alternative solution.

1. Power-Interest Grid

This model plots stakeholders on two axes: power (ability to influence outcomes) and interest (level of concern about the project).

You get four quadrants:

- High power, high interest: Manage closely

- High power, low interest: Keep satisfied

- Low power, high interest: Keep informed

- Low power, low interest: Monitor

It's simple. It's visual. But it's also static. You're guessing at power and interest levels based on titles and meetings.

2. Influence-Impact Matrix

Similar to the power-interest grid, but focuses on influence (ability to affect others' opinions) and impact (how much the project affects them).

Again, you categorize stakeholders and create engagement strategies for each group.

3. Salience Model

This model adds a third dimension: legitimacy. It considers:

- Power: Can they affect your project?

- Legitimacy: Do they have a rightful claim to involvement?

- Urgency: Does their claim require immediate attention?

Stakeholders with all three attributes get priority. It's more sophisticated than the grid models.

4. Stakeholder Circle

This visual model places stakeholders in concentric circles based on their proximity to the project.

Inner circle: Core team Middle circles: Significant influencers Outer circles: Peripheral stakeholders

You can also add attributes like attitude (supporter, neutral, blocker) and communication preferences.

5. RACI Matrix

RACI stands for Responsible, Accountable, Consulted, and Informed. This model maps stakeholders to specific roles in each project task or decision.

It's particularly useful for clarifying decision rights and avoiding confusion about who does what.

The Limitation of Traditional Models

Here's what all these models have in common: they're static and perception-based.

You create them in a workshop. People share their opinions about who has power or influence. You map it out. You move on.

Three months later, someone leaves. Teams reorganize. New people build influence through their work. Your stakeholder map is outdated.

Worse, these models rely on what people think happens. Not what actually happens.

Your VP might believe the engineering team follows formal processes. But maybe they really listen to a senior developer who's been there for years. Your stakeholder map won't show that.

This is where ONA changes everything. It doesn't rely on perceptions. It uses actual collaboration data: who talks to whom, who people turn to for advice, who connects different groups.

It updates continuously. It reveals the informal networks that traditional models miss. It shows you the Germany model when everyone assumed you had the France model.

Stakeholder Mapping Software: From Basics to ONA

When you search for stakeholder mapping tools, you'll find dozens of options. Let me walk you through what's available and why most tools miss the mark.

1. Spreadsheet Templates (Excel, Google Sheets)

The most basic approach. Templates with columns for stakeholder name, role, influence level, interest level, and engagement strategy.

What they do well: Simple to use. Free. Easy to customize. Good for small projects with few stakeholders.

The limitation: Completely manual. You're guessing at influence and interest levels. No data to back up your assessments. Gets unwieldy fast with large stakeholder groups.

2. Project Management Tools (Asana, Monday.com, Smartsheet)

These platforms include stakeholder mapping features as part of project planning.

What they do well: Integrate stakeholder tracking with project tasks. Allow team collaboration. Keep stakeholder information in one place with your project plan.

The limitation: Still based on manual input. They organize your assumptions but don't validate them. They track stakeholders you already identified but don't reveal the ones you missed.

3. Dedicated Stakeholder Mapping Software (Smaply, Miro, Lucidchart)

Purpose-built tools for creating stakeholder maps and matrices. Visual interfaces for plotting stakeholders on power-interest grids or influence-impact matrices.

What they do well: Professional visualizations. Multiple mapping frameworks. Collaboration features. Good for presenting stakeholder analysis to leadership.

The limitation: They make your manual analysis look pretty, but they don't make it accurate. You're still guessing who has influence based on titles and meetings. The map reflects your perceptions, not reality.

4. CRM and Relationship Management Tools (Salesforce, HubSpot)

These track stakeholder relationships, particularly external ones like clients, partners, and vendors.

What they do well: Comprehensive relationship history. Track interactions and communications. Good for managing ongoing stakeholder relationships.

The limitation: Focused on external stakeholders. Limited visibility into internal influence networks. Track formal relationships but miss informal ones.

5. Survey and Feedback Tools (SurveyMonkey, Typeform, Qualtrics)

Some companies use surveys to gather stakeholder input and assess attitudes toward projects or changes.

What they do well: Capture stakeholder opinions directly. Measure sentiment and concerns. Provide quantitative data on stakeholder positions.

The limitation: People tell you how they feel, but not who actually influences them. Response rates can be low. Doesn't reveal the network structure that determines how influence spreads.

Why Traditional Tools Aren't Enough

Notice the pattern? All these tools do the same thing: they organize and visualize information you manually input.

They don't tell you:

- Who actually has influence (not who should have it based on their title)

- How information really flows through your organization

- Which stakeholders are connected to which others

- Who the super-connectors are that reach most of the organization

- Where bottlenecks and silos exist that will block your initiative

Traditional tools assume you already know who matters. They help you track those people. But they can't reveal the informal influencers you're missing.

This is where Organizational Network Analysis changes everything.

Why ONA-Based Stakeholder Mapping Works Better

ONA doesn't rely on your assumptions. It uses actual data about how people connect and collaborate.

Let me show you what ONA reveals that traditional tools can't.

Organizational Network Analysis gives you what traditional stakeholder mapping can't: data on how people actually connect. Let me show you what ONA reveals.

Finding the Real Influencers

ONA identifies people with the most connections. In any group, about 3% of people hold the most influence. If you engage this 3%, you can reach 75-85% of the organization through their networks.

Here's why that matters. When you're leading change, you need early adopters to spread the message. The 3% rule tells you exactly who those people should be.

A manager might not be the best person to reach a certain group. Instead, teams often rely on a senior employee who's been there from day one. That senior employee might have more connections and more trust than someone with a fancier title.

ONA shows you who that person is.

Revealing Hidden Collaboration Patterns

ONA maps how different departments work together. You might discover that sales and product rarely connect, even though they should. Or that engineering depends entirely on one person to communicate with marketing.

I've seen this firsthand. One company found that information between sales and product only flowed through a single product manager. When that person went on vacation, communication stopped. That's a massive risk.

ONA also shows you where silos exist. If teams are detached from the rest of the organization, you need to create new connections before launching any change initiative.

Identifying Succession Risks

Who holds critical knowledge? Who connects groups that otherwise wouldn't talk?

ONA reveals your single points of failure. These are people who, if they left tomorrow, would break critical workflows. You need these people in your stakeholder map because they're essential to your operations.

Understanding Leadership Styles

Not all leaders operate the same way. Some are manager-driven. They control information and decision-making flows through them. Others empower distributed teamwork where the team connects directly with other groups.

ONA shows you which model each leader follows. This matters because different change approaches work for different leadership styles.

How to Do Stakeholder Mapping with ONA Tools

Let me walk you through how ONA actually works for stakeholder mapping.

Step 1: Collect Network Data

ONA tools gather data about connections and collaboration in two ways:

Active surveys ask employees specific questions about their networks:

- Who do you turn to for expertise?

- Who do you collaborate with most often?

- Who do you trust for leadership guidance?

These surveys take about 8 minutes. They give you deep insights into expertise networks, leadership connections, and cultural ties.

Passive data comes from your existing systems. Calendar integrations show meeting patterns. Communication tools reveal who talks to whom. Project management systems show collaboration on deliverables.

The beauty of passive data? You get continuous updates without jeopardizing employees’ privacy or asking employees to fill out surveys every month.

Step 2: Identify the Critical 3%

Remember the 3% rule I mentioned earlier? ONA tools automatically identify the people with the most connections.

These are your super-connectors. In any change initiative, engaging them first means you can reach 75-85% of the organization through their networks.

You don't have to guess who these people are based on job titles. The data shows you exactly who holds influence.

Step 3: Map Collaboration Patterns

ONA creates visual maps showing how different teams and departments connect.

You'll see:

- Which teams collaborate frequently

- Which teams are isolated (silos)

- Who bridges different groups (connectors)

- Who's overburdened with too many connections (burnout risks)

For stakeholder mapping, this reveals the informal structure of your organization. You can identify which departments need stronger connections before launching a cross-functional project.

Step 4: Analyze Leadership Styles

ONA shows whether each leader operates in a manager-driven style (all information flows through them) or an empowered style (the team connects directly with others).

This matters for stakeholder engagement. Manager-driven leaders need different approaches than those who've already distributed decision-making.

Step 5: Combine with Engagement and Performance Data

Here's where tools like Teamspective add value. ONA alone shows you the network. But you need context.

- Are disconnected teams performing poorly? That's a problem to fix.

- Are highly connected teams burning out? You need to redistribute work.

- Is a change initiative causing engagement to drop in specific groups? You can identify resistance early and address it.

By combining network data with engagement surveys and performance metrics, you get a complete picture of what’s working and what’s not.

Step 6: Run Continuous Analysis

Unlike traditional stakeholder maps that you create once and file away, ONA provides ongoing insights.

Passive data updates automatically. You can run pulse surveys to track how networks evolve. You see when new influencers emerge or when critical connectors leave.

This means your stakeholder map stays current. You're not making decisions based on three-month-old assumptions.

Step 7: Take Targeted Action

Once you've mapped stakeholders through ONA, you can design precise interventions:

- For change management, engage the influential 3% first. Give them early access. Address their concerns. Let them become your champions.

- For cross-functional projects, identify the connectors between departments and ensure they're involved from day one.

- For succession planning, find alternatives for single points of failure. Create redundant connections before someone critical leaves.

- For onboarding, connect new hires with people who understand how work actually gets done, not just what the org chart says.

The Benefits of Stakeholder Mapping

When you map stakeholders correctly (including the informal influencers that ONA reveals) you get several benefits.

Faster Change Adoption

You reach the right people first. They spread your message through their networks. This cuts the time needed for organization-wide adoption.

Better Resource Allocation

You stop wasting time on people who won't move the needle. You focus energy on influencers who actually drive behavior.

Reduced Risk

You identify single points of failure before they become problems. You spot disconnected teams that might resist change. You find overburdened employees before they burn out.

Improved Communication

You understand how information flows. You can design communication plans that follow natural pathways rather than fighting against them.

Higher Success Rates

Projects that include proper stakeholder mapping have better outcomes. You've aligned the people who matter. You've addressed concerns from trusted voices. You've built support through existing networks.

Organizational Resilience

When you distribute influence (the Germany model), your organization becomes more resilient. You're not dependent on a few central figures. You have strong leaders and connectors throughout.

Conclusion

Stakeholder mapping is all about understanding who really holds influence in your organization. Who people trust. Who spreads information. Who connects different groups.

Traditional methods give you the org chart. ONA gives you the real network.

I've seen the difference this makes. Companies that map stakeholders based on actual connections, not just job titles, have change initiatives that move faster and face less resistance. They operate like Germany: distributed power, multiple centers of influence, resilient networks.

If you're planning a change initiative, implementing new technology, or trying to improve collaboration, start with proper stakeholder mapping. Use ONA to reveal the informal networks that actually drive behavior.

Ready to see the power of ONA for stakeholder mapping? Book a demo today, and let our team of experts guide you.